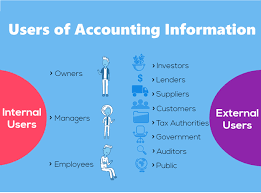

Users of Accounting information are the parties interested and uses accounting information in their decision making in order to measure the financial strength of a business. The users are grouped into two. They are internal ( i.e employees, management etc.) and external users ( i.e government, tax authorities, creditors)

Below are the users of Accounting information and their interest.

- Shareholders: These are the owners of the business. Shareholders need accounting information to measure the performance of the business to decide whether to continue business operation or to liquidate it. They are also interested in the value of shares and the dividend paid to them.

- Management : These are the people who administer and manage the operation of a business. Management may also need accounting information to measure the performance of the business. They need information relating to day -today operation of the business and the outside within which the business operates. Management may also need information about debtors, creditors, capital employed and profit of the business.

- Customers :These are the people or organizations that buy from the business. They are interested in the price, quality and availability of products of the business.

- Creditors : Creditors are the people or organizations that sell goods on credit to the business. They are interested in the ability of the business to pay its debt as well as how long it takes to do that.

- Employees :These are the workers of the business. Employees are interested in the business relationship with them such as hours of work, bonuses, wages and salaries and more.

- Financial Institutions : The bank management may also need accounting information to measure the performance of the business’ management in order to decide whether to lend money initially, continue lending, to reduce or to stop.

- Public Authorities : Authorities such as the Standard Board and GRA may need information relating to number of products produce, its quality and income respectively

QUALITIES OF GOOD ACCOUNTING INFORMATION

Below are the qualities of a good accounting information.

- Timely: Accounting information must be prepared on time so that affected parties can access it on the right time their decision making. Thus, it should not be too early or too late to be presented.

- Complete : The accounting information provided must cover all aspect of the business and not part. This will help end users of the information to make sound judgment.

- Cost Effective : The benefits to be derived from the information must be greater than the cost incurred in getting the information.

- Verifiability : The information must be capable of being cross checked or proved to be right or correct.

- Unbiased: The information provided must not be tailored to the needs of specific group but to the needs of all the end users. Thus, the information must be objective.

- Comparability : Accounting information should be comparable with those of other similar firms and from one period to another.

- Understandable : Accounting information should be of form which is understandable by the user groups. Thus, all material matters should be disclosed without unnecessary complex details.

Wanna earn money online, check in here

You must be logged in to post a comment.